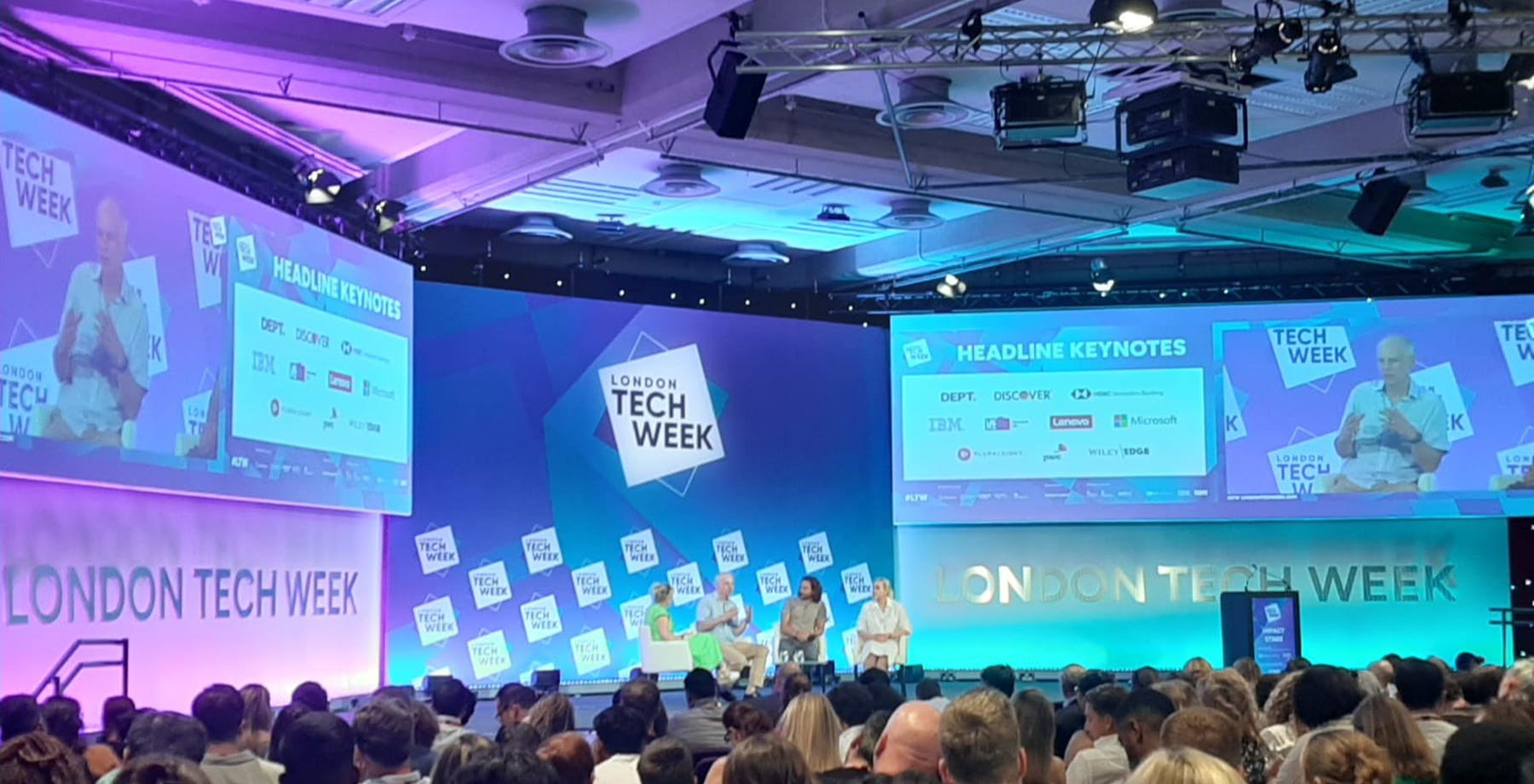

Our VC team have been immersed in the vibrant European start-up and VC ecosystem, attending three major conferences over the past couple of weeks. While Mike represented us at SuperVenture in Berlin, Joe and Michanne were actively involved in London Tech Week (LTW) and VivaTech in Paris.

These gatherings brought together a diverse array of investors, industry leaders, start-ups, and innovators from across the globe. They provided us with valuable insights into the latest trends and advancements in the tech landscape, as well as the prevailing sentiment among entrepreneurs, VCs, and their investors.

As a team, we've had numerous conversations sparked by our experiences, and we'd like to share some of the key highlights and takeaways that have shaped our reflections:

1. Investing in hype ain’t easy

Unsurprisingly, AI was a massive theme across both LTW and VivaTech. The myriad potential use cases have been covered elsewhere (including this post from our Innovation colleague Owen Eddershaw), but what we found most interesting was the conversation amongst investors about how to invest behind the trend.

As with the topic of AI itself – with a wildly broad spectrum ranging from “AI will kill all of us” to “AI will save the world” – there was no consensus and more questions than answers.

On one hand, the ‘horizontal’ models like Open AI’s GPT-4 have the potential to create some of the most important companies in history. That much is clear.

But how does that translate to actionable VC investment opportunities?

Can start-ups compete when Big Tech are also laser-focused on the space? What approach wins: open-source or closed-source? How important is proprietary data to defensibility? Will use-case specific beat out general models? Is this a “winner takes all” space? How much capital is required, and how quickly? How on earth do you value these companies? What are a VC fund’s realistic chances of identifying and being able to invest in a/the ‘winner’ given a significant proportion of the VC industry globally is trying to do exactly the same thing at exactly the same time? And ultimately, is the majority of funding that will inevitably flow into this space really just a value transfer from VCs to NVIDIA’s shareholders?

Perhaps serendipitously, perhaps deliberately, while we were on the ground at VivaTech the news was announced of the largest European seed round in history: $110m into Mistral AI.

On the other hand, ‘vertical’ applications with a tangible and specific use case are exploding given the broad-based applicability of AI tech to so many sectors, combined with the appetite from customers to use the tech and realise the benefits as soon as possible.

But where does the defensibility come from if the underlying models are third party and equally accessible to competitors? How can start-ups beat incumbents with massive distribution and data advantages? Is the tech really ‘ready’ to be used for high-stakes use cases? Will AI become ‘just’ a feature incorporated into existing products rather than spawning a generation of scaled new businesses?

Regardless of how it plays out, it’s going to be a fascinating one to watch. At True, we’re not going to try to pick a ‘horizontal’ winner but we are keeping a keen eye open for interesting applications within the Consumer and Retail sector.

2. The European ecosystem is massive

We’re always struck at the sheer scale of the major tech conferences, and despite the headwinds in the early-stage funding landscape, this time was no different.

Super Venture welcomed 800+ attendees, 250+ LPs and 500+ VCs. London Tech Week hosted 30,000 participants, while VivaTech in Paris saw an extraordinary 91,000 visitors (including 1,800 start-ups), from all over the world. On the VC investor side, even the informal WhatsApp groups we were in had several hundred participants from all over Europe.

In such a vast landscape, True’s Consumer and Retail sector specialism is invaluable.

From an investment perspective, it gives us a north star on which to focus, prioritising quality over quantity and allowing us to develop real expertise and depth of networks. As much as we’d love to, there are simply not enough hours in the day to cover all interesting start-ups and co-investors across every sector across multiple markets. Focus is key to keeping us sharp (and sane!)

With a wider lens on True’s business model, the presence of so many corporates hungry for innovation sifting through thousands of exhibitors underscored how overwhelming it must be to navigate the landscape of opportunities. That makes the value of the work of our colleagues in True’s Innovation team even more obvious – both to True’s partners and to us in the VC team as we get the benefit of their expertise and networks to help us find, back and support the best companies.

3. A healthy reset for VC

Today the Venture Capital market is a tale of two halves.

On one hand, it’s tough out there. The macroeconomic backdrop continues to make for a very challenging trading environment for most businesses (let alone startups!).

This is especially hard for early-stage companies as they develop their products, grow their teams and inevitably seek to raise capital in what is the most challenging fundraising market in over a decade. The harsh reality is that many will either struggle to raise or need to go through a painful reset (down-rounds, recaps, pay-to-plays) given the very different market landscape since the peak of 2020 and 2021, when many will have last raised funding.

But, the future is bright.

As difficult as this period will be for entrepreneurs and investors, the current market conditions represent a healthy reset in the industry, which is now being stripped back to first principles – building great companies – after a couple of years of existing in a ‘bubble’.

Overwhelmingly, LPs and fund managers are excited about the next decade of opportunity. Bear markets invite only the most passionate and committed founders to set up new companies and there are record levels of dry powder for investors to deploy right now. We are excited about backing this generation of entrepreneurs that are forging a path forward despite the short-term challenges.

As our team’s adrenaline returns to normal levels after many (many!) hours of talking, listening and learning in various parts of Europe, we’re incredibly excited.

Yes, the venture market is tough, but we have capital to invest in a much less competitive climate. Yes, the landscape is complex, but we have a sector specialist focus and the wider True platform to help us navigate that complexity. And yes, AI might go rogue and be the end of humanity, but it could also be one of the most meaningful tech paradigm shifts in history.