Investment, reimagined

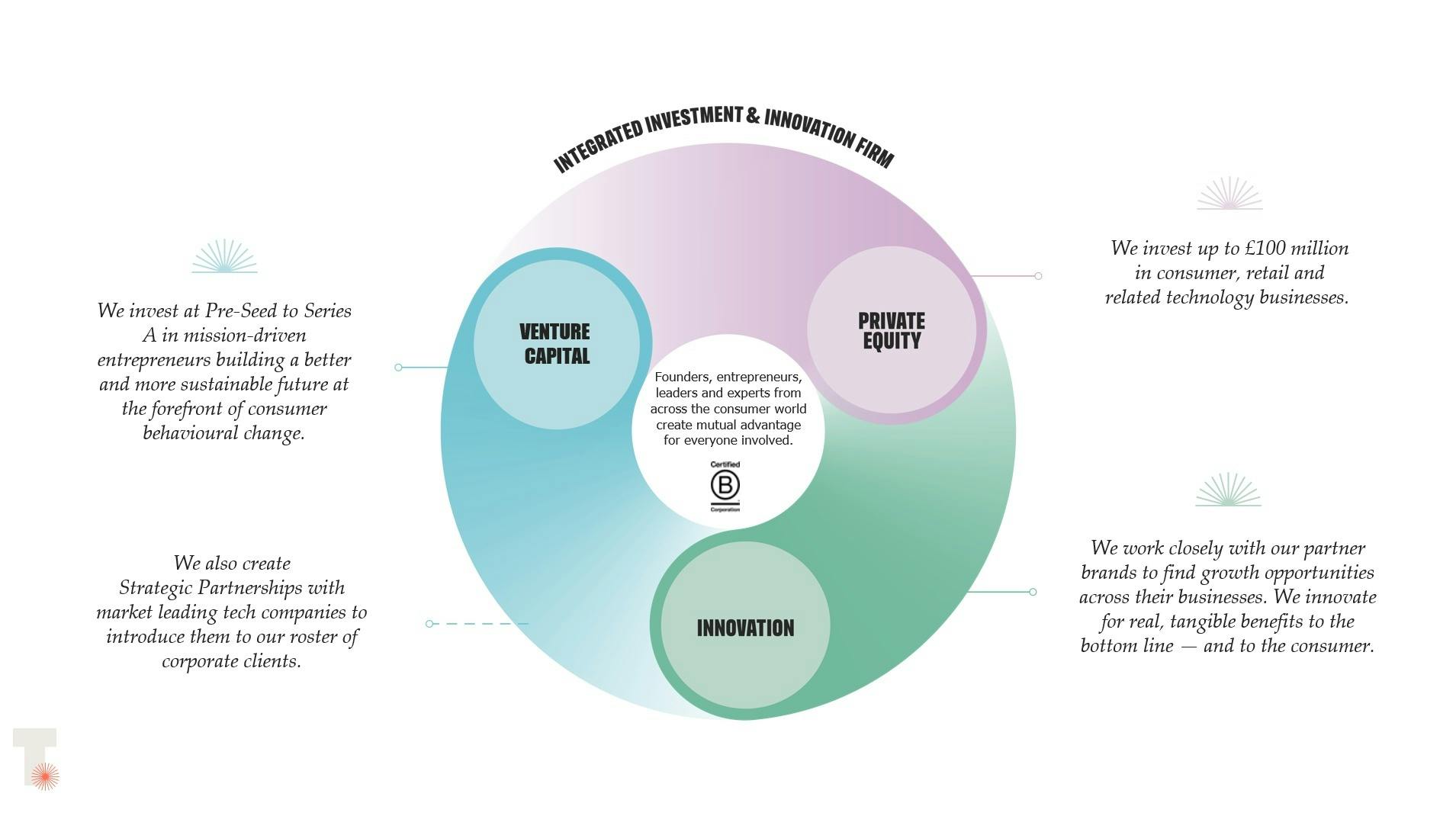

We have two funds - one private equity, one venture capital - dedicated to investing across the retail, consumer and technology ecosystem.

Private Equity Investments up to £100m

We invest across the retail, consumer and technology ecosystem including B2C, B2B and B2B2C. But investment is only one part of what we do for them. We nurture the businesses that we believe in, giving them everything from access to emerging technologies, to extraordinary collaboration opportunities from across our network to share best practice and create new ideas.

Venture Capital Initial Investments up to £2m

We back mission-driven entrepreneurs building a better and more sustainable future at the forefront of consumer behavioural and technological change.

Apply here

Office Hours

We are passionate about increasing access for underrepresented founders. Our Office Hours program provides an opportunity for you to explore whether venture funding is right for your business - get transparent feedback on your pitch deck, business model, and funding readiness from our venture capital team.

If you feel you lack the connections and context needed to secure VC funding, our team is keen to lend their experience in the industry and hear your story. If you’re a founder from an underrepresented background who lacks existing connections, we want to help open that door.

True Investment stories

News

The Cotswold Company deliver record sales of £100m in 'milestone year'.

The Cotswold Company (TCC) celebrates a milestone year, strengthening its position as a leader in premium homeware. With a focus on quality, craftsmanship and a growing omnichannel presence, the brand continues to resonate with consumers seeking timeless, made to last furniture.

News

The Ribble Outlier Gravel Team’s Sophie Wright takes double podium with the ALL-GRIT.

A huge congratulations to Sophie Wright from The Ribble Outlier Gravel Team, who placed on the podium twice on the international gravel racing circuit on the ULTRA-GRIT.